Real Estate Investment in Sarasota

Why Sarasota?

It is the "high quality of life" that has brought Sarasota into a remarkable growth mode,

bringing along substantial real estate investment opportunities.

General

Real Estate Investments may be for a variety of reasons, the major ones being:

1. Acquisition of a home to live in it indefinitely. This is a long term investment, for which the value, in line with the increased demand for residency in Sarasota, is likely to keep increasing over time.

2. Commercial acquisition, for the purpose of generating income. The key aspect to consider is the Return on Investment, which will be discussed further on.

3. Acquisition for speculation, i.e. generally for a quick return, based on “buying low” and then “re-

All these types of investments are affected by Location, Timing and General Business/Economic Conditions, and while business cycles are a fact of life, history shows us that over the long range these cycles average in an upward trend.

In summary, all investors may benefit from:

- Buying at bargain prices.

- Ample supply to choose from.

- Favorable mortgages & loans.

- Anticipated increase in value.

- Investment security.

Best Practices

The goal is to Obtain Optimum Results in a Competitive Market and at Minimum Risk.

Residential Versus Commercial Real Estate

It is well known that with the Purchase as well as with the Sale of residential properties, emotional factors are likely to play an important role. However, like the commercial investors, whose focus is on the Return on Investment, everybody wants, and rightfully so, deserves "Value".

To that end, for residential and commercial investors alike, maximizing market exposure and performing a sound financial evaluation ensure maximum satisfaction.

Maximum Market Exposure

Market Exposure, tailored to local conditions, is a most effective marketing approach.

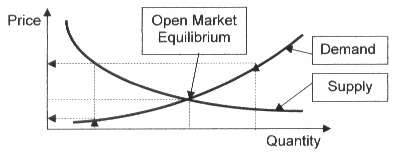

Thus, below is the basic Supply & Demand relationship in our free and competitive market environment.

Thus: The higher the demand, the higher the price.and the larger the supply, the lower the price.

By far, the best market exposure is obtained through the Association of Realtors' Multiple Listing System, commonly referred to "MLS", a fully integrated information system on the Web, so far unique to the United States, accessed by every qualified real estate agent of the region.

This Multiple Listing provides a detailed description, together with photographs, pertinent data and information of every property listed therein for sale to virtually thousands of local real estate agents.

This immensely broadened exposure through the MLS permits the potential buyer to work with just one agent rather than needlessly keep hopping from door to door from one agent to the next.

Furthermore, the MLS-

Making Money on Real Estate Investment

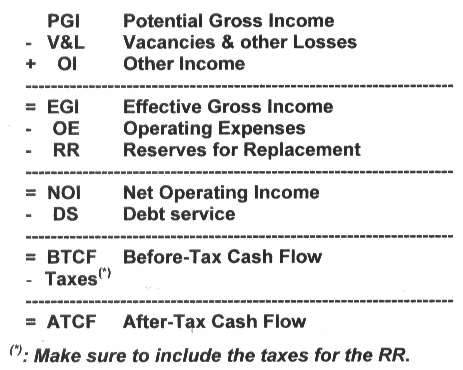

As indicated earlier on, the purpose of Real Estate Investment is to obtain a most favorable ROI, i.e. Return on Investment. To that end, an investor, prior to entering a transaction, evaluates the economics very carefully, i.e. at the Profit & Loss of the business and verifies that the pertinent financial data compare favorably to the prevailing industry ratios as well as to the personal needs and expectations.

Below is a basic computation of the major figures.

Furthermore, in order to limit the impact of unforeseen events, all risks should be properly assessed and methods for risk mitigation should be developed.

Again, expert support is highly recommended.

Aspects not to be Overlooked

Favorable Financing & Competitive Banking, Equal Opportunity for Non-

Risks Assessment & Risks Mitigation.

-

-

-

-

-

-

-

-

Therefore, one cannot overstress the value of professional support.

Special Real Estate Investment Opportunities

Location, location, location ... is the real estate ‘leitmotiv’. A thorough local knowledge will help to find that ideal location.

Tax-

Commercial investors may benefit from a 1031 Tax-

This kind of exchange permits an investor to acquire a more desirable replacement property without paying captal gain taxes during the replacement process.

To qualify for a 1031 Exchange, properties must be of a same kind, though grade and/or quality may be different. The exchanged properties, however, must be located in the United States.

Foreclosures, Bank Owned Properties and Short Sales

They occupy a special place within real estate investment opportunities, as they can provide exceptional bargains, especially during a buyer's market like the one we are in today. However, they are bound to higher risks. Also, with a corresponding complex, non-

Green Houses

Investing in certified green houses may prove to have additional benefits to investors in respect to lower operating and maintenance costs, because they meet more stringent quality and energy saving specifications in addition to being expected to be healthier environment to live in.

© 2006, 2010, 2015

John Buecheler